The world of stock market investing can seem like a complex maze, full of jargon and high-stakes decisions. For many in India, the idea of putting their hard-earned money into shares feels intimidating, perhaps even risky. But what if we told you it’s one of the most powerful tools for wealth creation over the long term? With the right knowledge and a disciplined approach, anyone can navigate the stock market, even as a complete beginner.

This guide is designed to demystify stock market investing for you, the aspiring Indian investor. We’ll break down the essentials, walk you through the practical steps, and share smart strategies to help you begin your journey with confidence.

Why Should You Consider Investing in the Stock Market?

Before diving into the ‘how,’ let’s understand the ‘why.’

- Potential for High Returns: Historically, equities (stocks) have offered better returns than traditional investment avenues like fixed deposits or gold over the long run.

- Beat Inflation: Your money loses purchasing power over time due to inflation. Investing in stocks can help your money grow faster than inflation, preserving and increasing your wealth.

- Compounding Power: This is the magic of earning returns on your initial investment and on the accumulated returns. The longer you stay invested, the more significant the impact of compounding.

- Ownership in Companies: When you buy a company’s stock, you become a part-owner. As the company grows and profits, so can the value of your shares.

It’s crucial to remember that while the potential for returns is high, so are the risks. The stock market can be volatile, and prices can go down as well as up.

Understanding the Basics: Your Stock Market ABCs

Before you commit your money, let’s get familiar with some fundamental terms:

- Stock/Share: A tiny unit of ownership in a company. When you buy a stock, you own a piece of that company.

- Stock Exchange: These are marketplaces where stocks are bought and sold. In India, the two primary stock exchanges are the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

- Indices (Nifty 50 & Sensex): These are like barometers for the market.

- Nifty 50: Represents the weighted average of 50 of the largest Indian companies listed on the NSE.

- Sensex: Represents the weighted average of 30 well-established companies listed on the BSE. They indicate the overall health and direction of the broader market.

- Broker: An intermediary (a company or individual) that facilitates buying and selling of stocks on your behalf on the stock exchange. You need a broker to trade.

- SEBI (Securities and Exchange Board of India): The regulatory body that governs the Indian securities market. Its primary role is to protect investors’ interests and promote the development of the market.

- Bull Market: A period when stock prices are generally rising, signaling optimism among investors.

- Bear Market: A period when stock prices are generally falling, indicating pessimism and a downward trend.

- Dividend: A portion of a company’s profits that is distributed to its shareholders. Not all companies pay dividends.

- Volatility: Refers to how quickly and significantly a stock’s price fluctuates. High volatility means rapid price swings.

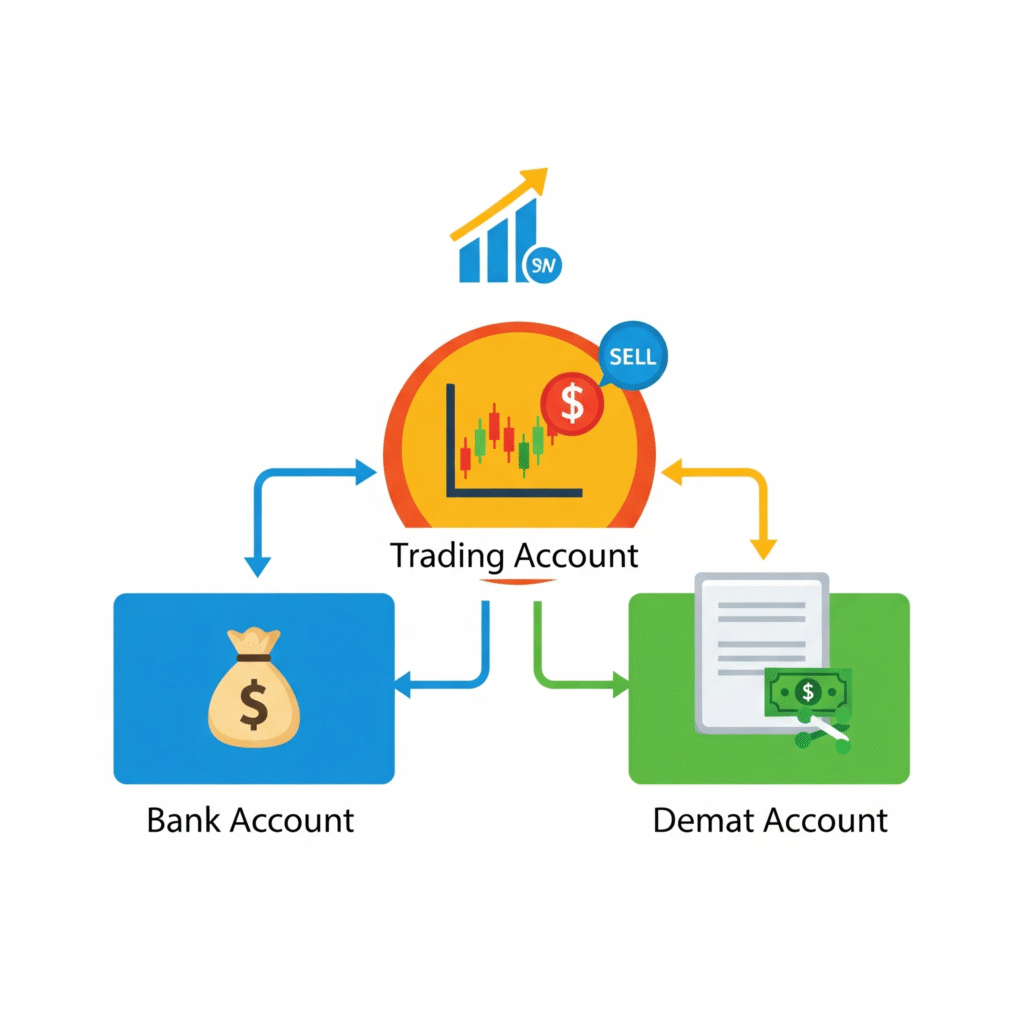

Getting Started: The Essential Accounts You Need

To start investing in the Indian stock market, you need two crucial accounts:

- Demat Account (Dematerialised Account): Think of this as your digital locker for shares. When you buy shares, they aren’t given to you physically; instead, they are held electronically in your Demat account. It’s safe, convenient, and eliminates the risk of theft or damage to physical share certificates.

- Why is it needed? SEBI mandates that all shares traded in India must be in dematerialised form.

- Trading Account: This is your gateway to the stock exchanges. It’s the account through which you place buy and sell orders for shares. Your broker provides the trading platform (website or app) linked to this account.

How to Open Demat and Trading Accounts:

The process is largely online and streamlined nowadays:

- Choose a Depository Participant (DP) / Broker: This is the first and most critical step. Your DP is usually a bank or a brokerage firm registered with either NSDL (National Securities Depository Limited) or CDSL (Central Depository Services Limited) – the two depositories in India. Look for a reputable broker with:

- Low brokerage charges (transaction fees).

- User-friendly trading platform (website/app).

- Good customer support.

- Research tools and resources for beginners.

- Strong security measures.

- Popular Indian brokers include: Zerodha, Upstox, Groww, ICICI Direct, HDFC Securities, Angel One, Motilal Oswal, etc. (Do your research to find the best fit for you).

- Fill the Application Form: Visit your chosen broker’s website or app and initiate the “Open Demat Account” process. You’ll fill out an online application form with your personal details.

- Submit KYC (Know Your Customer) Documents: This is a mandatory verification process as per SEBI guidelines. You’ll need to upload scanned copies of:

- Proof of Identity (POI): PAN Card (mandatory for all), Aadhaar Card, Passport, Driving License, Voter ID.

- Proof of Address (POA): Aadhaar Card, Passport, Driving License, Voter ID, Utility Bills (not older than 3 months), Bank Statement.

- Bank Account Proof: Cancelled Cheque, Bank Statement, or Bank Passbook copy (ensure your name and IFSC are visible).

- Income Proof (Optional but required for Futures & Options/Derivatives): Latest salary slip, ITR acknowledgment, bank statement (last 6 months), Form 16.

- Passport-sized Photographs.

- Signature Image.

- In-Person Verification (IPV) / Video KYC: Many brokers now offer video KYC where you complete the verification remotely via a video call, showing your original documents.

- E-Sign the Agreement: You’ll typically sign the Demat and Trading account agreements digitally using your Aadhaar-linked mobile number (e-sign).

- Account Activation: Once your documents are verified and approved, your Demat and Trading accounts will be activated. You’ll receive your account number and login credentials.

Essential Strategies for Beginner Investors

Now that you have your accounts, how do you actually invest?

- Define Your Financial Goals: This is the most crucial step. Why are you investing? For retirement, a down payment on a house, your child’s education, or just wealth creation? Your goals determine your investment horizon (how long you plan to invest) and your risk tolerance.

- Example: A goal for retirement 20 years away allows for higher risk and long-term growth. Saving for a down payment in 2 years requires lower risk.

- Understand Your Risk Tolerance: How comfortable are you with the idea of your investment value fluctuating, or even temporarily declining?

- Conservative: Prefer lower risk, stable returns (e.g., large-cap stocks, debt funds).

- Moderate: Willing to take some risk for potentially higher returns (e.g., mix of large-cap and mid-cap stocks).

- Aggressive: Comfortable with higher risk for maximum potential returns (e.g., small-cap stocks, growth stocks).

- Start Small and Invest Consistently (SIP in Stocks): You don’t need a huge sum to begin. Start with an amount you’re comfortable losing. Consider a Systematic Investment Plan (SIP) approach for stocks – investing a fixed amount regularly (e.g., ₹2,000 every month). This averages out your purchase cost over time and reduces the impact of market volatility (known as rupee-cost averaging).

- Focus on Long-Term Investing: For beginners, trying to “time the market” (buying low and selling high in the short term) is often a recipe for disaster. Focus on investing in fundamentally strong companies for the long term (5+ years). This allows your investments to ride out short-term market fluctuations and benefit from compounding.

- Diversify Your Portfolio: Don’t put all your eggs in one basket! Spread your investments across different companies, industries, 1 and even asset classes (like a mix of stocks, mutual funds, and perhaps even some bonds) to reduce risk. If one sector underperforms, others might compensate. 1. www.trendri.com www.trendri.com

- Research Before You Invest: Never invest based on tips or social media hype. Always do your own research:

- Understand the Business: What does the company do? Is it a business you understand?

- Financial Health: Look at its revenue, profit, debt levels, and cash flow (found in annual reports).

- Management Quality: Is the management team competent and ethical?

- Industry Outlook: Is the industry growing?

- For beginners, sticking to blue-chip stocks (large, established, financially stable companies) is often a safer starting point.

Risks to Be Aware Of

Investing in the stock market isn’t without its risks:

- Market Volatility: Stock prices can fluctuate wildly due to economic news, company performance, or global events.

- Loss of Capital: There’s a risk of losing some or all of your invested capital if the stock price declines significantly.

- Liquidity Risk: Some stocks might be difficult to sell quickly without affecting their price, especially smaller, less traded ones.

- Company-Specific Risk: A company’s poor performance, bad management decisions, or industry disruptions can impact its stock price.

Smart Tips for the Beginner Indian Investor

- Build an Emergency Fund FIRST: Before you even think about investing in stocks, have an emergency fund (3-6 months of living expenses) in a liquid account. This prevents you from having to sell your investments at a loss during a crisis.

- Continuous Learning: The stock market is dynamic. Keep learning about new concepts, market trends, and economic indicators. Read financial news, books, and reputable blogs.

- Avoid Emotional Decisions: Don’t panic sell during market corrections, and don’t get greedy during bull runs. Stick to your investment plan. Fear and greed are the biggest enemies of investors.

- Don’t Borrow to Invest: Never invest money you cannot afford to lose, especially borrowed money.

- Review Your Portfolio Regularly: Periodically review your investments (e.g., once or twice a year) to ensure they still align with your goals and risk tolerance. Rebalance if necessary.

- Seek Professional Advice: If you feel overwhelmed or have complex financial situations, consider consulting a SEBI-registered financial advisor.

Starting your investment journey in the stock market can be a rewarding experience, paving the way for significant wealth creation. Remember, it’s a marathon, not a sprint. With patience, discipline, continuous learning, and a focus on long-term goals, you too can unlock the potential of the Indian stock market. Happy investing!